Willing Parties: Jack Evans didn’t act alone, so why haven’t his law firms faced scrutiny?

By Pete Tucker | Photo and additional reporting by Jeffrey Anderson

Published at DistrictDig.com

The longest-ever D.C. Council career came to an end, or at least a pause, on January 17. Had Jack Evans not resigned at that time, all twelve of his colleagues were prepared to take the unprecedented step of expelling him from the Council.

Ten days later, with the ink on his resignation letter barely dry and a federal investigation hanging over his head, Evans announced he was running for the Ward 2 Council seat he just vacated–using public matching funds to do it.

It’s a bold move, if you discount what Evans engaged in at the highest levels of D.C. government over the last couple decades. Now, his bid for his old seat presents an opportunity to shine a brighter light not only on his dealings, but also on the law firms where he worked.

For almost the entirety of his 29-year Council career, Evans was on the payroll of powerful law and lobbying firms. The exception to this, aside from an eight-month break in 2015, was Evans’s last two years on the Council, when his outside income came exclusively through a personal firm he created (in the summer of 2016).

Through NSE Consulting LLC, clients with business before the city paid Evans around $430,000 over three years, “largely for merely being available,” according to a 100-page Council report.

“We found no evidence there was any traditional consulting work being done other than perhaps talking on the phone or the occasional meeting,” said Steve Bunnell, of the law firm O’Melveny & Myers, who led the Council’s three-month investigation of Evans.

While official investigations and local reporting (led by District Dig) have shined a light on Evans’s solo exploits, a quarter century remains shrouded in darkness. During this earlier period Evans, as a sitting legislator, took home the bulk of his estimated $4 million in outside income, mostly from white-shoe law firms.

Evans’s role at these firms provided the blueprint for NSE. That’s according to Evans himself, who wrote that there was “no real distinction or difference” between how he served private clients at law firms versus at his personal consulting firm.

Evans’s only client to speak with Council investigators made the same point. According to the Council report, Colonial Parking CEO Rusty Lindner “understood” that Evans was providing him with “the same valuable strategic services” at NSE as he had at law firms.

Lindner was in a position to know, since he paid for Evans’s services not only at NSE but also at Patton Boggs and Manatt, Phelps & Phillips, two of the three law firms where Evans worked over the course of his Council career. (Evans also worked at BakerHostetler.)

The prestige of these firms helped obscure Evans’s dealings. Had he remained in their service, he would likely still be reigning over D.C.’s budget as chairman of the recently deconstructed Committee on Finance and Revenue, doling out favors to undisclosed clients.

It’s crazy to think, but Evans’s undoing wasn’t his influence peddling, just the vehicle he used to carry it out.

“I have long suspected that these firms were aware of and participating in this culture of corruption that Evans represents,” Craig Holman, Capitol Hill lobbyist for the nonpartisan watchdog group Public Citizen, told The Dig.

For these firms, “Evans was a means to get what they wanted for their clients in exchange for money,” Holman said, referring to what he believes to be improper influence over government decisions.

For instance, Holman takes issue with documents produced during the Council investigation in which Evans solicits prospective employers with the services he could offer to their clients “given my position” in local government.

In one job solicitation, sent from his Council email address, Evans told the law firm Nelson Mullins he would be able to engage in “cross-marketing my relationships and influence” to the benefit of the firm’s clients. (He later blamed a partner of the firm, Rob Hawkins, who had once been an aide to Mayor Muriel Bowser, for having re-written the pitch without his knowledge.)

“Any law firm would recognize that to be a damning piece of evidence that they should have turned over to the FBI,” said Holman, noting that law enforcement did not start looking at Evans until after media reports began to pile up.

Patton Boggs

My journey into Evans’s ethically suspect dealings started a dozen years ago when I came across a picture. The photo itself was unremarkable but its location blew me away.

What was a smiling Jack Evans doing on Patton Boggs’s website? I’d heard he worked for the firm, but advertising it like this seemed brazen. Then I read the last sentence of Evans’s Patton Boggs bio: “Additionally, Mr. Evans advises clients on real estate matters.”

In a 2010 op-ed for the Washington Post I noted how alarming that line was:

“In his capacity as chair of the finance and revenue committee, Mr. Evans plays a pivotal role in many ‘real estate matters,’ involving billions of precious District tax dollars and public property. Examples include the baseball stadium, the convention center and now the convention center hotel. It needs to be asked: Which hat does Mr. Evans wear when he helps put these massive deals together?”

Within days of my Post op-ed, Patton Boggs took action. Not by reforming its ways, just by lopping off the “real estate matters” sentence from Evans’s bio. And onward they went, the ethically suspect Council member and the juggernaut lobbying firm.

At Patton Boggs, Evans studied at the feet of its longtime leader, Tommy Boggs, who died in 2014. “I worked closely with him a lot,” Evans told Council investigators. “We had lots of conversations about politics, about what was going on, things of that nature.”

Boggs’s firm wasn’t known for ethical purity. “We pick our clients by taking the first one who comes in the door,” Boggs said.

Yet Tommy Boggs was a master of developing personal relationships, and with that mastery he turned the firm into a pioneer at exploiting the “revolving door” by hiring ex-officials to influence their former colleagues.

Evans’s hiring in 2001 offered a new twist, with Patton Boggs placing a sitting legislator with outsized influence over the city’s budget on its payroll. Evans’s pay seems to have reflected his new perch as finance chair, going from $50,000 per year at BakerHostetler to initially around $125,000 per year at Patton Boggs, which later bumped him up to $190,000 per year.

The extent to which Evans used his public office to benefit Patton Boggs’s clients has long been obscured by the size and prestige of the firm, as well as D.C.’s lax disclosure laws. While Evans had to reveal that Patton Boggs employed him, he didn’t have to say who the firm’s clients were.

“I’ll know it when I see it,” Evans told investigators, invoking the famous quote by former U.S. Supreme Court Justice Potter Stewart to describe his policy on when to report potential conflicts of interest. (Stewart was referring to obscenity.)

Still, there were signs that something was fishy.

In 2004, for example, Evans voted on a tax break for CareFirst. He did so, the Washington Times’s Jim McElhatton reported, without disclosing that the healthcare company was a Patton Boggs client. Evans, in fact, was listed as having personally lobbied Congress on CareFirst’s behalf. Somehow Patton Boggs was able to dismiss this as just “a simple mistake” in their filing.

In February 2010, as Northrop Grumman looked to move its headquarters, Evans publicly offered the defense contractor $25 million or more in taxpayer subsidies if it relocated to D.C. “Whatever someone else puts down we’re going to match it and we’re going to beat it,” Evans said, fueling a bidding war between D.C., Maryland and Northern Virginia, where the defense contractor ultimately landed.

That same year Northrop Grumman became a Patton Boggs client and over the next three years paid the firm $720,000, according to Open Secrets.

Even before Northrop Grumman paid Patton Boggs directly, it was tied to the firm through the Breaux-Lott Leadership Group, which the defense contractor had paid $1.5 million over the previous three years. When Evans made his “$25 million-or-more” offer to Northrop, Patton Boggs was two years into a “strategic alliance” with Breaux-Lott, journalist John Hanrahan reported.

Conflict of interest questions again swirled in 2011, this time over the role Evans played in steering $272 million in public subsidies towards the construction of a 1,200-room Marriott hotel alongside the Convention Center two years earlier.

As this was happening, Patton Boggs told the Post that it didn’t represent Marriott, leaving out a crucial detail, one that could cause the firm problems if disclosed: While Marriott wasn’t a client, Patton Boggs represented a major financing partner in the hotel deal, the real estate banking giant ING, which stood to benefit from the public funding the District was pumping into the project thanks to Evans.

Later in 2011, Evans introduced a bill that would move D.C.’s money out of big banks and into three local banks. One of those was EagleBank, where Doug Boggs–Tommy Boggs’s son, a partner at Patton Boggs–was on the advisory board, the Washington Business Journal reported.

“I had no idea he was on the board,” Evans claimed.

While Evans’s 2011 bill failed, similar legislation passed in 2014. Meanwhile, D.C. deposits at EagleBank soared, going from $25 million in 2011 to $67 million in 2019, the Post reported.

By late 2014, Patton Boggs was no longer king of the hill. The once dominant lobbying shop had fallen on hard times, having been hurt by the 2008 financial crisis and its aftermath, as well as a lawsuit against Chevron that turned out badly for the firm. Also, Tommy Boggs had passed away, just after his firm had merged with the larger Squire Sanders, leaving Evans to prove himself to new bosses.

In an October 2014 memo entitled “Jack Evans Strategic Plan,” Evans highlighted his outreach to “my contacts” at 12 companies that might hire the merged firm, including Exelon, the Illinois-based nuclear giant that was seeking to complete its takeover of Pepco, the utility provider for D.C. and surrounding Maryland counties.

In pursuing Exelon as a client, Squire Patton Boggs apparently saw Evans as one of its chief selling points. In an October 2014 draft pitch to Exelon, below an invitation to “contact us if you require any additional information,” all the firm provided was Evans’s contact information and the photograph of him smiling.

Evans also received top billing in the pitch for Squire’s proposed “Acquisition Advocacy Team,” where his bio noted his Council roles and highlighted his “strong experience in public policy, municipal affairs and public sector financial and tax policy.” (It’s unclear whether Squire sent Exelon the 16-page draft pitch. The firm didn’t respond to a request for comment.)

With his lucrative second job on the line, Evans was hustling, the Council report showed. That same month, he met with Exelon’s general counsel, who he invited to Squire’s holiday party. In December, he drafted a personal cover letter to accompany Squire’s draft pitch to Exelon (“I will reach out to you in the New Year. In the meantime, I can be reached at…”).

Soon thereafter, Evans arranged for an Exelon executive to meet with Mayor Bowser.

Despite Evans’s efforts, Squire didn’t land the Exelon account and Evans was let go in January 2015, setting him on a downward trajectory from which he never recovered.

By late 2015, however, Evans was at another firm, at a reduced salary of $60,000. He sought to make up for his loss in income by setting up his own personal firm, in July 2016, which he modeled on what he’d learned at Patton Boggs, he told Council investigators.

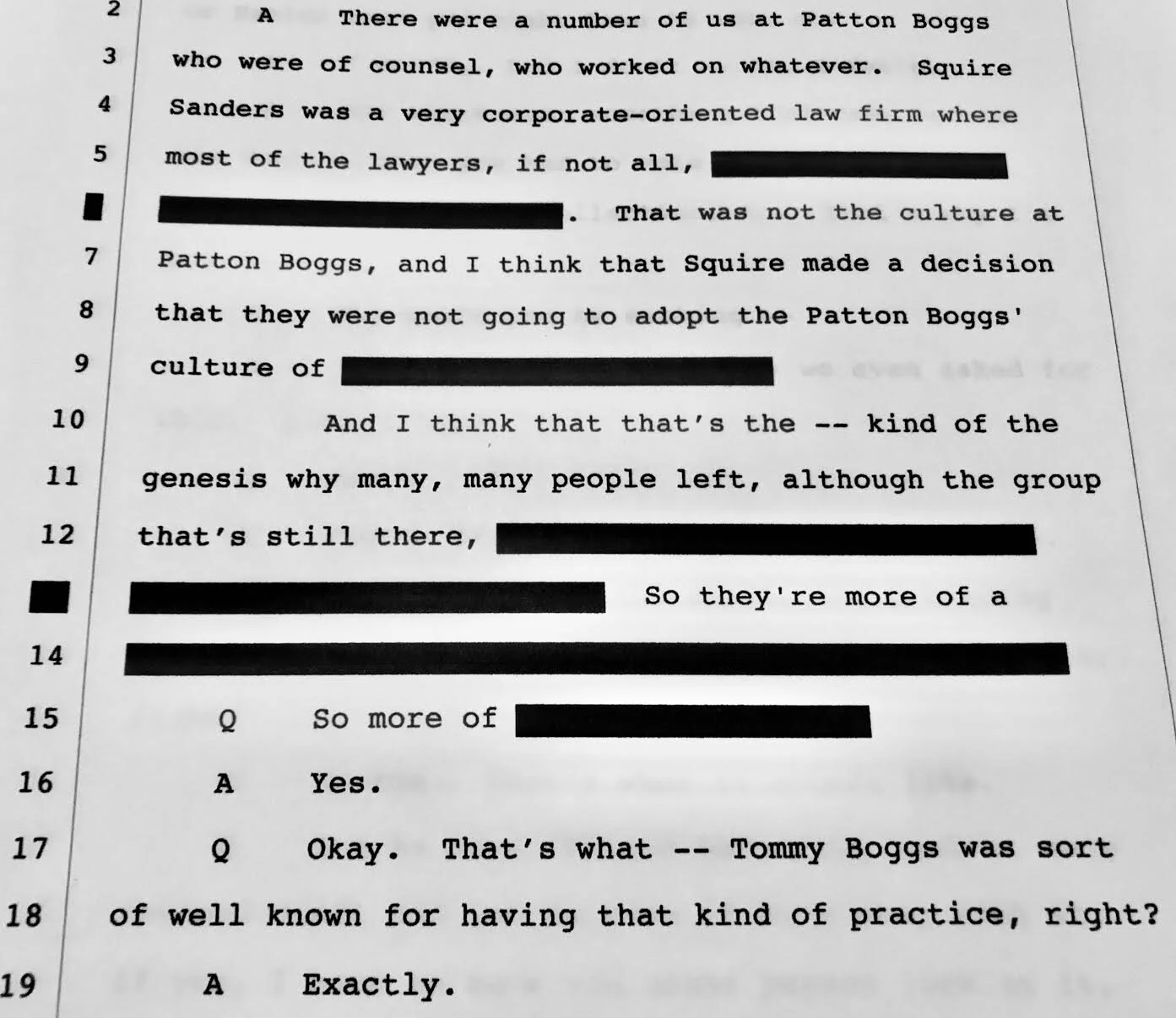

“I was available to do what [my NSE clients] needed me to do when they contacted me, if they ever did. So it was a retainer agreement, very similar to the ones that existed at Patton Boggs with many, many people, including Tom [Boggs… who] probably had 100 retainer agreements with people who never called, never contacted him ever. So that’s kind of the setup that was in place with my clients.”

Evans’s time at Squire Patton Boggs may have contributed to his downfall, but he has remained loyal to the firm, which even considered hiring his private consultancy for a project in 2018. The Council report found that Evans “could not recall any specific matter on which he worked, nor could he recall any other lawyers with whom he worked” while at Squire Patton Boggs.

Manatt Phelps

Nine months after being let go by Squire, Evans rejoined 13 of his former Squire colleagues, including two of Tommy Boggs’s sons, at Manatt, Phelps & Phillips, a firm known to “regularly sweat city officials.” While Evans had been unable to secure Exelon as a client for Squire, he was now working for the firm that represented both the nuclear giant and Pepco.

Even before his October 2015 arrival at Manatt, Evans was quietly helping the firm. For example, at a January 2015 Council hearing on the proposed $6.8 billion Pepco-Exelon merger, Evans said, “Pepco is doing a good job in improving electric reliability here in the District, but I believe that the improvements will be further accelerated if the merger of Pepco and Exelon is approved.”

While those appeared to be Evans’s words, they belonged to Manatt lobbyist Tina Ang, who provided Evans with his statement, the Council investigation found.

Four months later, in May 2015, the Council initially approved $250,000 to study the feasibility of a publicly owned utility replacing Pepco. The unanimous vote caught Pepco and Manatt off guard, and the lobbying firm sprang into action. To kill the study, Manatt needed to flip seven of the Council’s 13 members at the second and final vote the following month.

As the vote neared, Manatt closely coordinated its efforts with Evans and his office. In an email that began “Grrrl,” Ang wrote to Evans’s chief of staff, Schannette Grant, “We would like your help in arranging a ‘team’ meeting with [councilmembers] Orange, Todd, Bonds on Monday.”

Later that month in a 7 to 6 vote, these councilmembers, along with Evans and two others, passed an amendment that effectively killed the feasibility study.

“This is plainly a Pepco amendment, lobbied by Pepco representatives… Pepco’s fingerprints are all over it,” Councilmember Mary Cheh said after the vote. Pepco’s influence “runs through our entire government.”

Cheh didn’t know the half of it. Ahead of the vote, as Evans was in employment negotiations with Manatt, Ang emailed his chief of staff to say that “for obvious reasons” they would have Councilmember Anita Bonds introduce the amendment to kill the study.

Evans officially started at Manatt on October 5, 2015. Less than two weeks later he was the first signatory on a Council letter calling on the D.C. Public Service Commission to approve the Pepco-Exelon merger.

The commission, which had rejected the merger in August 2015, was all that stood in Exelon’s way, as regulators in four states and the federal government had signed off on the deal.

After receiving the Council letter–which was signed by seven Council members, a bare majority–the commission reversed course and approved the $6.8 billion merger, in March 2016. Evans never informed his Council colleagues or the commission that his new firm represented both Pepco and Exelon, which spent upwards of $250 million to get the deal approved by various regulatory bodies.

When Council investigators asked Evans about the letter his memory fogged up again. “A letter was drafted. I don’t know by whom… It was brought in to me by someone,” Evans said.

John Ray, Manatt’s chief D.C. lobbyist and Evans’s close friend and former Council colleague, wasn’t any more forthcoming. “Ray declined to state whether he or Manatt played any role in drafting the letter, responding: ‘anything that I have done on [Pepco’s] behalf is privileged,’” according to the Council report. Ray, who was in close contact with Evans while they were at the same firm, also told Council investigators, “how we used Jack is privileged.”

How Manatt “used Jack” may have even concerned Evans.

In a May 2016 letter, Evans requested a legal opinion from D.C.’s Board of Ethics and Government Accountability (“BEGA”). “It has come to my attention that Manatt continues to represent [Pepco and Exelon],” wrote Evans. “If I receive a flat salary from Manatt that excludes any incentives and Manatt agrees not to lobby the Legislative and Executive branches of the District government, I ask for your opinion as to whether I may vote on matters before the Council affecting Pepco or Exelon.”

The ethics board didn’t grant Evans the absolution he sought. If it had it would have done so under false pretenses, as Manatt didn’t stop lobbying, nor did the firm pay Evans a flat salary. (Evans’s base pay at Manatt was $60,000 but with incentives and bonuses he could earn up to $500,000 a year, according to his contract. Evans’s pay only surpassed $60,000 once at Manatt, reaching $82,961.54, in 2017.)

When Evans made these representations to the ethics board, he did so with Manatt’s knowledge. In fact, the firm helped draft his letter. In an email to Grant, Evans’s chief of staff, Ray wrote: “I made a few changes to Jack’s draft letter to BEGA. Please have Jack look at this revised draft and let me know if he’s okay with it. If yes, I have to have one other person look at it and then we’ll be good to go.”

Evans’s and Manatt’s roles in the Pepco-Exelon merger appear to be under federal investigation, based on documents subpoenaed by federal authorities from the Council and Mayor Bowser in 2019.

I was the first to report that Evans took official action benefitting Pepco and Exelon while he was in negotiations with, and employed at, Manatt. Three years after my 2016 HuffPost story (“Some Go to Jail–Not Jack Evans”), and just days before the subpoenas hit requesting documents related to the Pepco-Exelon merger, Evans’s and Manatt’s potential conflicts of interest involving the merger began to appear in news reports.

But those stories neglected important aspects of the wheeling and dealing that surrounded the merger. For example, in June 2015, Evans co-introduced a bill (that passed) to have D.C. pay Pepco–his soon-to-be employer’s client–$40 million for land in Southwest D.C. that was slated to house a new soccer stadium. D.C. would also sell a different piece of property to Pepco for $16 million.

Amid negotiations for this land swap, a separate and stranger deal materialized. In September 2015, just a month before Evans’s start date at Manatt, Pepco agreed to pay D.C. $25 million upfront for the naming rights to an unspecified number of streets and parks, for an unknown period of time, mostly around the not-yet-built soccer stadium.

In response to this “highly, highly unusual” and “virtually unprecedented” agreement, just two pages in length, Public Citizen and the Chesapeake Climate Action Network issued a joint report:

“[W]as Pepco actually out to get naming rights? Or was the return on their $25 million investment beyond the soccer stadium? With Mayor Bowser’s acceptance of the Pepco-Exelon merger ‘settlement’ agreement released just days after this vague naming rights deal was made, these questions must be answered.”

(Bowser denied that the naming rights deal was related to her support of the merger.)

It’s unclear if Manatt or Evans were involved in the machinations that preceded Bowser’s flip, which paved the way for the $6.8 billion merger. But it certainly worked out well for Manatt’s big-spending clients, Pepco and Exelon.

And it’s hard to miss telltale signs of Evans’s involvement: The naming rights deal was spurred on by the land swap, which Evans co-introduced; involved streets and plazas adjacent to the soccer stadium Evans pushed to build with $150 million in public subsidies; buoyed the city’s finances, which Evans oversaw; centered on Pepco, a client of Evans’s soon-to-be firm; and was negotiated by Evans’s close friend (and current attorney) Mark Tuohey, then Bowser’s legal counsel.

By the end of 2017, as conflict of interest questions swirled again, Evans’s time at Manatt quietly came to an end. He’d lasted just two years with Ray, a shorter stint than their first time together, at another firm, where Evans first forged his long path to political ruin.

BakerHostetler

Thirty years ago BakerHostetler had not one but two sitting D.C. councilmembers on its payroll: Jack Evans and John Ray.

Evans’s employment at BakerHostetler began in 1988, three years prior to his election to the Council, and lasted almost his entire first decade in office, he told Council investigators. (Ray said he was on the Council the “entire time” he was at BakerHostetler, from 1988 to 1994.)

While little is known about how BakerHostetler used Evans (or Ray), the firm paid him $50,000 a year and apparently made him a partner while in office. (Evans told Council investigators he wasn’t a partner when he was first elected, though later Post stories — here and here — refer to him as such.)

So when did Evans make partner and what did he do while in office to earn it? Neither BakerHostetler nor Evans responded to requests for comment.

As he would do time and again throughout his illustrious career, Evans in at least one instance took official action benefitting a BakerHostetler client: In 1996, he supported a law that made it easier for businesses in D.C. to convert into stock companies.

BakerHostetler’s client, Ohio-based Central Benefits Mutual Insurance Co., took advantage of the 1996 law after domiciling in D.C. In 1999, the company made Evans a vice president–while still retaining BakerHostetler as its law firm–paying him around $500,000 over the next decade, even though his duties were “really not much,” Evans told the Post.

Evans still has ties to BakerHostetler. Tuohey, a prominent white-collar defense attorney who is of counsel to the firm, has provided Evans with legal services during his scandal. (As has renowned white-collar defense attorney Abbe Lowell of Winston & Strawn.)

Tuohey and Evans go back a ways, joining forces to fight for public funding of the baseball stadium in 2005. Evans, the deal’s “unlikely savior,” according to Washingtonian magazine, calls this his “crowning achievement,” and told the Council’s investigators, “Mark Tuohey here and myself… built that baseball stadium.”

Tuohey also served as head of the D.C. Sports and Entertainment Commission, a position he got thanks to Evans. Their efforts must have pleased Major League Baseball’s top D.C. lobbyist, Bill Schweitzer, the managing partner of BakerHostetler’s D.C. office from 1993 to 2009.

At a January 2005 dinner held at the firm on the night of George W. Bush’s second inauguration, Schweitzer welcomed “Major League Baseball executives, politicians, and businessmen,” along with select guests Tuohey and Evans, according to Washingtonian.

Just one month before, Evans had shepherded through a crucial 7 to 6 vote in favor of the publicly funded stadium.

Knowing what we know now about Evans, questions abound. With the baseball stadium, did Evans have a conflict of interest, as he did with the Pepco-Exelon merger and any number of ventures involving the District of Columbia and either Manatt or Patton Boggs?

If so, what does that say about the law firms who were parties to his activities and profited from his influence on the Council?

Despite holding office for nearly three decades, more than two of them while employed by some of the most prestigious law firms in the country, D.C. has yet to reconcile where Evans’s influence peddling begins, with where the role of his employers ends.